Explain Difference Between Capital Market and Money Market

While both capital markets and the money market restrict who can trade directly the money market is the near exclusive realm of very large institutions banks and governments while individuals can gain access to capital markets by. Datta capital market may be defined as a complex of institutions investment and practices with established links.

Difference Between Money Market And Capital Market Javatpoint

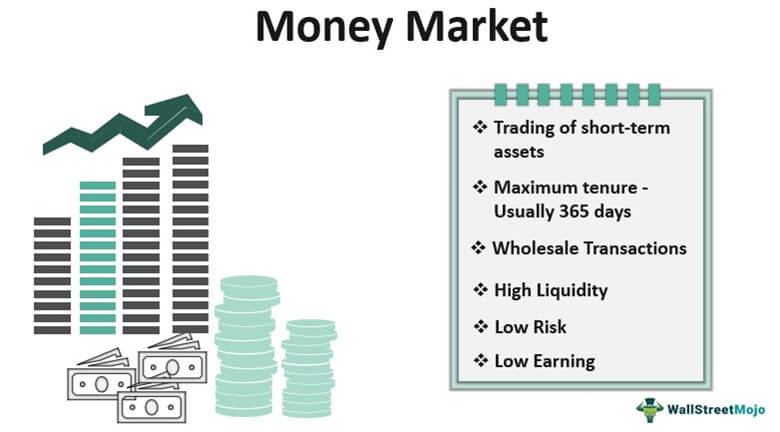

Due to high liquidity and low duration of maturity in money markets Instruments in money markets are a low risk whereas capital markets are the comparatively high risk.

. The money market is the short term lending system while the capital market is the trade in stocks and bonds. ABC of Money Investing Solutions Stocks and Securities Capital Market vs Derivatives Market Understanding the Differences Both derivative and equity capital markets are global exchanges where small and large businesses alike can come together with the objective of raising capital and hedging against a variety of risks. This is not unexpected as compared to the money market.

Shares Debentures Bonds Retained Earnings Asset Securitization Euro Issues etc. On the other hand the term Money Market refers to trading in very short. CDs can be issued by scheduled commercial banks and select All-India Financial.

Money market returns are often low but steady while capital markets offer higher returns. Capital markets have more risk as compared to money markets. Capital markets are well organized whereas money markets are not that organized.

Capital markets are formal in nature. Money market is a section of the money related business in which budgetary instruments with high. The most common markets are the stock market and bond market.

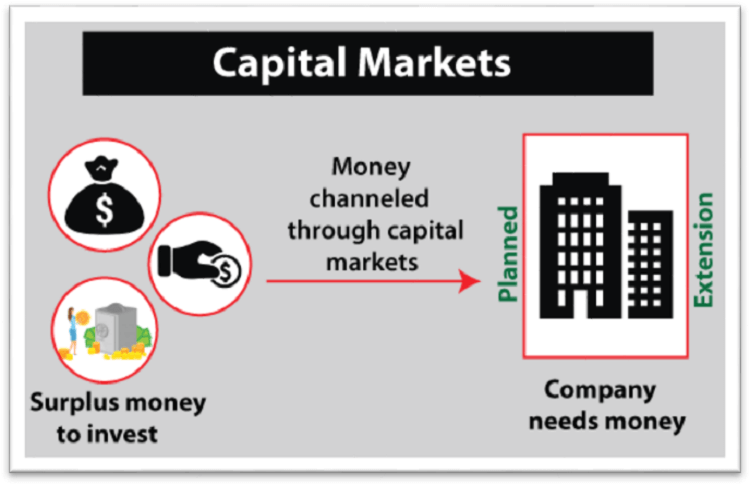

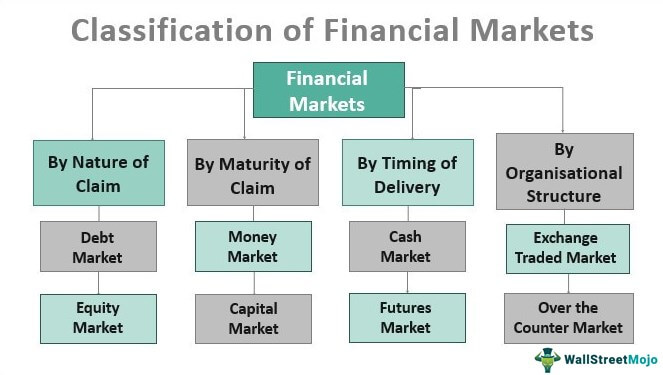

Capital markets seek to improve transactional efficiencies which bring suppliers together with those seeking for capital and provide a place where they can exchange securities. Ans it with suiatble headings. Classification of Financial Market.

Define the difference between the capital market and money market. And b Capital Market. Capital markets deal with financial instruments that are having a lock-in period of more than one year.

CP can be issued for maturities between a minimum of 7 days and a maximum of up to one year from the date of issue and can be issued not less than 5 lakhs and multiples thereafter. Capital and money markets where the local authorities play an important part. What is the difference between money market and capital market.

Explain howmonetary policy can influence these markets and. In the early post-war years local authorities borrowed almost wholly from the central government through the Public Works Loan Board. Treasury Bills Commercial Papers Certificate of Deposit Trade Credit etc.

Capital markets have a significant risk in comparison to money markets. A money market is where a business would deal with borrowing or lending for a short period of time whereas a capital market is primarily aimed at raising capital and would thereby include transactions which are for a long period of time generally over a year. Difference Between Money Market vs Capital Market Capital Market.

Money markets have low risk. The money market refers to all institutions and procedures that provide for transactions in short-term debt instruments gene View the full answer. Capital Market is well organised which Money Market lacks.

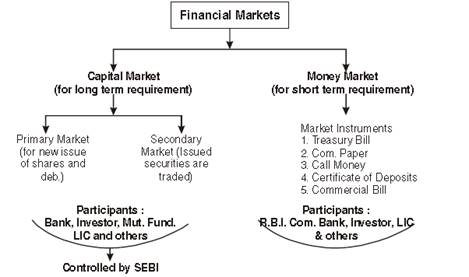

From the beginning of 1953 they were allowed to. Money market securities enjoy a. A financial market consists of two major segments.

Capital market is for selling and buying of debt and equity instruments. Capital markets trade in both debt and equity which is ownership investment such as stocks. Capital markets offer higher-risk investments while money markets offer safer assets.

Instrument matures in a year. The instruments traded in money. Money markets are used for short-term lending or borrowing usually the assets are held for one year or less whereas Capital Markets are used for long-term securities they have a direct or indirect impact on the capital.

Money markets have a low risk. I practitioners in the capital market are more heterogeneous ii capital market is less regulated and as such the price-settling mechanism is more volatile and free as the price in the market reflects the actual condition and expectation of market participants about future market conditions and iii within. Capital market securities are considered liquid because of the stock exchange but compared to money market instruments these are less liquid.

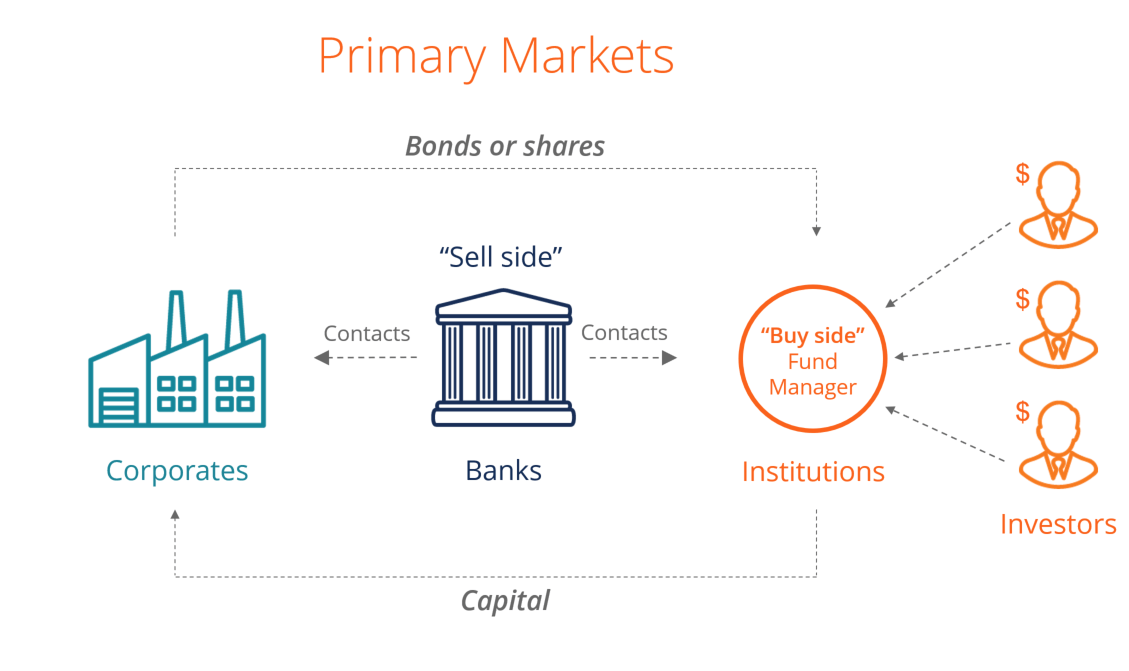

Liquidity is high in the money market whereas liquidity is comparatively low in capital markets. Capital markets are relatively more minor liquid. Capital markets are composed of primary and secondary markets.

While the money market deals in short-term credit the capital market handles the medium term and long-term credit. Ii Capital Market DefinitionAccording to Aran K. There are two types of capital markets namely.

The key distinguishing feature between the money and capital markets is the maturity period of the securities traded in them. Money markets are informal in nature. Securities that are traded in Capital Market include stocks bonds debentures etc.

I Money Market DefinitionAccording to Crowther the money market is the collective name given to the various firms and institutions that deal in the various grades of near money. Capital markets are those market where trading of assets such as bonds equity and securities take place. Instruments take much time to get mature.

Trade Credit Commercial Paper Certificate of Deposit Treasury Bills are some examples of short-term. Difference between Capital Market Money Market and Commodity Market Capital Market. A money market and a capital market are both financial markets.

Certificate of Deposit CD is a money market instrument. Money markets are incredibly fluid. Now that we have an understanding of the capital and money markets and also looked at the different types of financial instruments lets summarize the key differences.

Capital Market Its Meaning And Components Tutor S Tips

Securities Related To Money Market What Is Money Market

Money Market Instruments Meaning Types Objectives Features

Difference Between Money Market And Capital Market Javatpoint

/96254593-5bfc388546e0fb00514871c3.jpg)

Money Market Vs Capital Market What S The Difference

Capital Market Functions Structure Types Features

Money Market Vs Capital Market All You Need To Know

Financial Markets Class 12 Notes Business Studies Mycbseguide Cbse Papers Ncert Solutions

Capital Markets Definition Types Functions Boycewire

Important Questions For Cbse Class 12 Business Studies Meaning Functions And Classification Of Financial Market

Important Questions For Cbse Class 12 Business Studies Meaning Functions And Classification Of Financial Market

Money Market Definition Instruments Rates How It Works

What Is Financial Market Definition Function And Types Business Jargons

Classification Of Financial Markets 4 Ways To Classify Financial Markets

Primary Market How New Securities Are Issued To The Public

/GettyImages-824185000-03c0d898d7e449ac8fef137d17f73dd1.jpg)

Common Examples Of Marketable Securities

Difference Between Money Market And Capital Market Bbalec Capital Market Money Market Finances Money

Difference Between Money Market And Capital Market Javatpoint

What Are Capital Markets Functions Types Primary Secondary Efm

Comments

Post a Comment